- Home → Archive: September, 2016

Ultimate Guide to make Money from Forex Trading

Introduction to Forex Trading

The world of forex is complex indeed. There’s so much to be learnt and incomplete knowledge about forex, well can be dangerous. I started investing in the Forex world a couple of years back, and it has been a rewarding ride.

Forex trading carries with it a number of dangers. If you aren’t careful, you might just find yourself in a huge debt. Of course, if you know how everything works, you can make quite a bit of money too.

This is why you need forex trading for beginners.

Let’s take a brief look at what the forex market really is. Technically, forex trading is defined as the market where global currencies are exchanged. The main participants in this market are of course banks and many financial centers.

But that doesn’t mean only large financial institutions take part. There are small financial firms too and dealers who deal with quite a lot of money too, sometimes even to the tune of over hundreds of millions of dollars.

Forex trading by and large has little supervision as it has international trade and there’s no sovereign authority controlling it.

2. What if you want to become a part of this forex trading system?

One can make big money here if they understand the complexities of the foreign trading system. Say the currency exchange rate of $1 to another currency is translates to 10 units of the other currency when you buy it. Later, when the same exchange rate becomes $1 = 14 of the other currency, you can sell what you have to earn a handsome margin of profits.

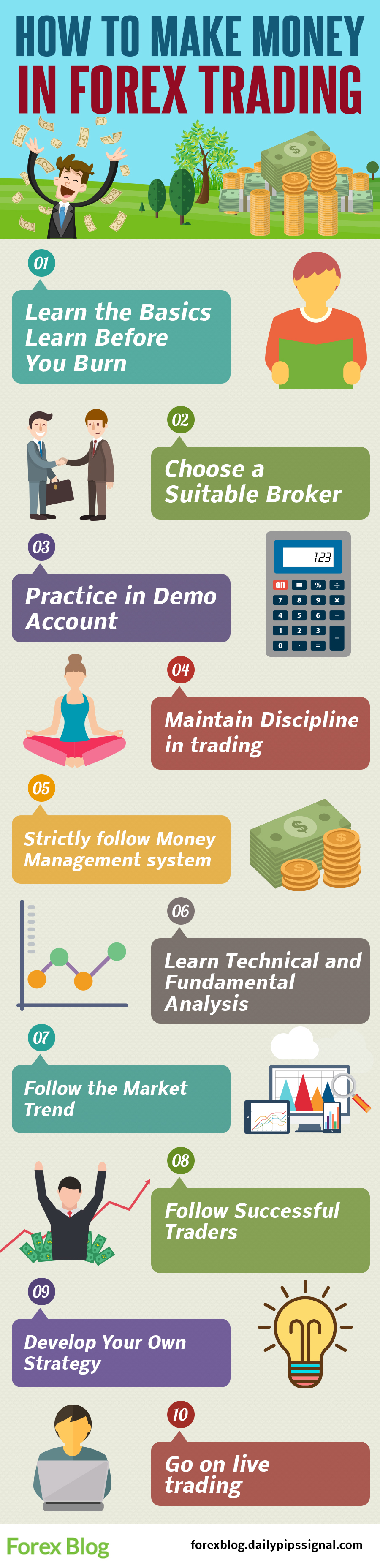

Things to do before starting forex trading:

Forex trading is undoubtedly a huge source of making money. Before starting to trade you should have the basics of forex trading. If you have those ideas, you will get confidence in trading. Keep in mind forex is not a gambling platform to make money overnight. If you can develop a strategy that work, it will be potentially profitable for your trading career.

You can do the following things to be successful in forex trading

(a) Learn the basics of forex trading

(b) Choose a Suitable forex Broker

(c) Open a demo account and practice it

(d) Follow a successful trader

(e) Develop your own strategy

(f) Trade in Live account

3. How to Make Money from Forex Trading?

Having a trading strategy is the single most important factor in successful forex trading. Traders who don’t utilize a strategy have a clear idea why this is important.

“A trading strategy may be important, but it is how you integrate it with other aspects of your trading activities that will determine your level of success.” We are going to help you by walking you through how to build your very own trading model.

l Your strategy dictates where to enter and exit a trade, the duration of the trade, money management practices and even risk management criteria you use.

l The next step is to identify the forex security you will be trading.

It could be assets or currency pairs.

Your choice should be made after careful consideration.

They don’t carry the same amount of risk.

3.1 Include Forex Specific Parameters

The next step in building your trading model is to include four specific parameters.

News is important because you cannot ignore how the news will affect the market.

Your model should also have any timing dependencies that you may want to include.

You could decide to only enter the trade just before Macroeconomic figures are announced.

The next step is to set your trading objectives.

This means that you should incorporate the following values into your trading model and keep testing and tweaking until you find the right fit:

Profit levels

Stop loss levels

Money Management techniques

Risk Management criteria

3.2 Consistent and Continuous Testing

No trading model is perfect at conception stage;

it takes a while to make it work just right.

The time is well spent testing and re-testing every aspect of the trading model.

The model should not only work but is consistent with your trading style.

Before a trading model can become perfect, you will have to exercise discipline and patience.

3.3 Get Idea of Currency Volatility

Technical analysis works much the same as it does to analyze the stock market. It’s assumed that the current price reflects the news, charts, and other objects of analysis.

Fundamental analysis, on the other hand, is difficult when it comes to the forex market. This is because unlike businesses, countries do not have balance sheets.

“Fundamental analysis of the forex market will correlate economic conditions and a nation’s currency valuation.”

Several fundamental factors that play a major role in a currency movement.

In order to understand fundamental analysis for forex, we need to look at these factors.

3.3.1 Economic Indicators

The following economic indicators that play a major role in fundamental analysis:

Gross Domestic Product: Most traders will use two reports that are issued just before the GDP as a basis for their fundamental analysis.

Retail Sales: Retail sales can accurately determine the direction of an economy, making it the most important factor in fundamental analysis.

Industrial Production: The utility production in a country can significantly affect its currency.

Consumer Price Index: Traders focus on the Consumer Price Index as prices of exports affect volatility of currency.

3.3.2 Other Indicators

Economic indicators are just some of the vital factors to assessing the volatility of a currency. Other technical factors and third party reports can actually have valuable information.

Short Profit Level - If you're looking to trade forex, know that you can also make a short profit. Many forex players look at making short profits instead go long term profits - and you need to have a level in mind. Once the forex level reaches that, it's time to sell.

Stop Loss level - If you're experiencing loss, do not worry. A little loss is okay, but have a stop loss level in mind or the level the you would want to sell the currency, to avoid making more loss.

Tips to Do Better in Forex Trading

1. Use experience

Use all of your experience in online trading. Read books and consult experts. Join forums online and be up to date with the current trends. Even if it was a hobby before, you might have learned an important lesson in the process. Know what your mistakes were in the past and try to avoid them. More importantly, study the market behavioral patterns. Create time to improve upon your skills.

2. Get the required skills

If you seek to be professional in trading then, get a professional degree in finance, business or related degrees. There are four-year relevant programs like investment management, international markets, banking, corporate finance, global economy, and business economics. In addition, develop strong analytical, interpersonal and communication skills. This will help bring more business.

3. Get the necessary tools

Are you using the right tools? Like other business professions, there are tools that can make your work process easier. Today, you have predictable analytics software that can help you know the trends easily. Get a good analytics software or trading software that can automate your work to the utmost; however, do not rely on these software wholly as it can be fatal. These will help you analyze or manage your investment in more effective way.

4. Self-development

As you will be working from home, you may not have chance to interact with the best in the business. Make sure you visit forums, webinars, seminars, or conventions. This will help you meet the best traders in the business. Interaction with other traders will help you learn more about the business. If you can afford to spare a little money, you can get a mentor who might stay close to you during your first few months when your work as a consultant.

Understanding Forex Trends

One important factor in forex-trends. Trends are basically movements on a graph, which when plotted, gives us an idea of the currency, which direction it is headed in, and its movements over the recent past. Trends are very useful, because, if you see a consistent upward trend between a currency pair, then you are in a better position to take a call regarding the transaction of that particular pair. Trends are vital, because they are numerical, absolute, and represent the most raw form of data, that a forex trader can use to his advantage to trade currencies.

The collection of data points plotted on a chart, shows the general direction of the currency.In some cases, it is easy to identify the trend. Forex trading, however, is not at all predictable, and sometimes you may see a haphazard trend, i.e, the rise and fall, often between short spaces of time.

A trendline is a charting technique, in which a line is added to represent the trend in a currency trend. It is as simple as drawing a straight line that follows a general trend. Trend lines, are useful in identifying trend reversals.

Studying and understanding trends, is important, so you can trade and profit from the general direction in which a currency pair is heading. Not paying attention to trends, could attract monetary losses. Losses, when small, can be swept under the blanket as learning experiences. But, long term losses could drain your funds. Hence it is important to observe, and study the prevalent trend. Forex trading is all about analyzing data, and getting the most out of it.

Making Money in Forex

I believe if you have the right strategy, you would be able to make a lot of money in Forex. Study the market carefully before investing and do not take uncalculated risks - it is important to know the basics well.